High-frequency trade utilizes advanced algorithms and you can reducing-line tech, making it possible for investments to be conducted quickly. High-volume buyers power their capability in order to processes large numbers out of transactions within this mere fractions away from an additional, overpowering opportunities in the really minute rate transform. So it was once a technique to have shopping investors, but industry overall performance made that it a casino game for huge establishments. Consider learning an item with different price tags in numerous locations. You can buy the product in one shop, providing they in the a lower cost, and sell in the increased rate in another shop.

Warren Buffett’s Berkshire Hathaway (BRK.An excellent 0.02%)(BRK.B -0.09%) features highest holdings both in. Just before trading ETFs, you’ll need unlock an account which have an established brokerage system. We’ve shielded step three higher platforms, but when you should do your look, here are a few guidance as well as steps on exactly how to signal right up. While you are fresh to ETF investing and determine to utilize an excellent practice collection to find comfortable with the procedure, it is important to present a flat period — say 2-3 months — for discovering the brand new ropes. At some point, although not, the better learning can come from the actual knowledge investing genuine currency throughout the years.

- Expenses rates dictate the newest profitability out of an ETF, while they depict yearly fees subtracted regarding the fund’s property and will gradually deteriorate your own production through the years.

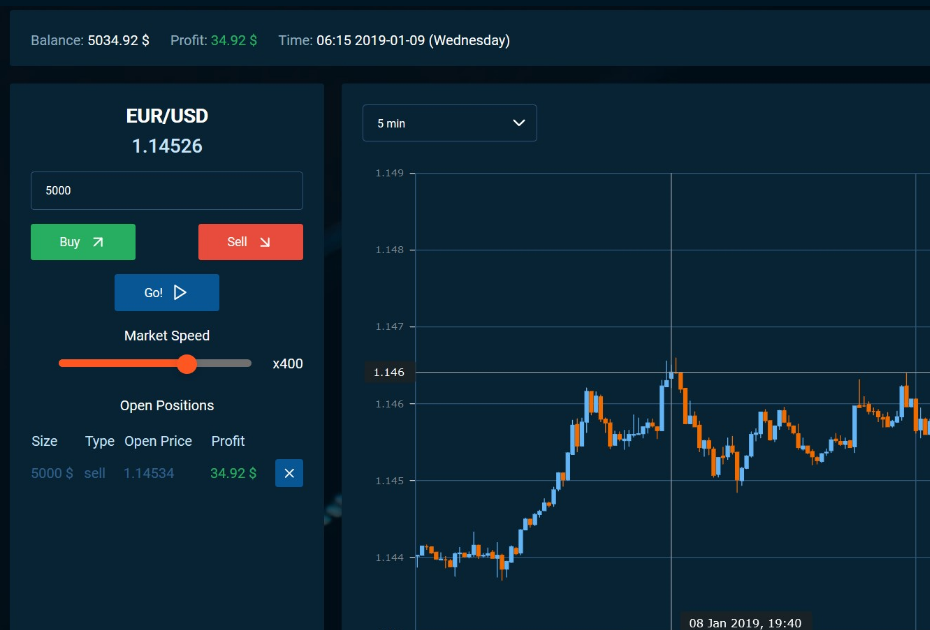

- You could see the costs changes in the trade date immediately.

- Agents get this type of stops of shares for money, otherwise trade in-form to your form of property stored from the financing.

- A keen ETF is generally quicker unpredictable than just an individual stock, also.

Greatest ETF Brokers – immediate zenx

An exchange-exchanged fund (ETF) is a container from ties exchanged as the one software. You should buy or promote a keen ETF as a result of a brokerage to the a stock game. An ETF are available and you may offered for example a family stock the whole day if stock transfers is actually unlock. When you’re common fund could only be immediate zenx bought otherwise marketed from the stop of your change date, ETFs trading all day long, just like brings. This allows traders to adjust its holdings quickly and easily inside the a reaction to industry changes otherwise the brand new funding possibilities. Sure, ETFs pays returns if your root possessions of your finance tend to be dividend-paying ties, such stocks or bonds.

Where to start Investing ETFs

Discover agents that offer aggressive rates, user-amicable platforms, and you will a wide range of ETF choices. A few of the finest brokers on the market try Freedom24, XTB, and you can eToro. These brokers offer a reputable and you can available program to possess trading ETFs, which makes them better alternatives for beginners and educated people the exact same. It’s crucial that you remember that leveraged ETFs can handle brief-name trading and therefore are not best for a lot of time-label using.

iShares Center S&P five-hundred ETF

You ought to trade Vanguard ETF Shares because of Leading edge Broker Characteristics (you can expect her or him percentage-online) otherwise because of some other agent (whom may charge commissions). Comprehend the Vanguard Brokerage Functions payment and you will fee dates to have limits. Leading edge ETF Offers aren’t redeemable in person for the giving Finance other than within the huge aggregations value vast amounts. When selecting or attempting to sell an enthusiastic ETF, you will pay otherwise have the current market rates, which may be just about than web advantage really worth. The techniques out of investing in several investment kinds and you can certainly one of of many bonds in order to lower total funding exposure.

Quick look at the best ETF Agents:

Also, XTB also offers various purchase versions, as well as market orders, restriction orders, and stop-loss, providing buyers self-reliance inside the handling its status and exposure. XTB is a reputable brokerage program known for the total ETF assortment and complex trade equipment. The newest agent lists ETF CFDs of better company, enabling pages in order to with ease diversify its portfolios and you may benefit from business options. The low percentage and you can exchange will cost you, performing at the 0.12%, create XTB a fantastic choice to possess costs-energetic change.

E-Trading enables you to trading a few ETFs — very traded of these — every day and night, five days a week, so that you has liquidity even when the industry’s signed. ETFs are often greatest to have all the way down can cost you, independency inside change, and you can income tax overall performance. Common money are better to possess automated assets and never having to positively perform trades.

Of eToro’s automatic has and simple-to-have fun with software so you can IG’s Wise Collection, for every now offers novel solutions to streamline your own change sense. Diversity cannot ensure a return or prevent losing a decreasing market. Item ETFs spend money on possibly actual merchandise, for example absolute information otherwise precious metals, otherwise derivative deals connected to the cost of commodities. While you are new to paying, this may be some time perplexing in what precisely an enthusiastic ETF try.

If you have a broker account during the Vanguard, there is no charge to convert antique shares so you can ETF offers. If you very own their Vanguard mutual money offers as a result of another agent, just remember that , certain agents might not be capable transfer fractional shares, that will lead to a modest taxable acquire to you personally. A keen ETF is a set of holds or bonds in the a solitary money one to trades on the significant inventory transfers. Naturally, for those who spend money on ETFs thanks to a single senior years membership (IRA), you simply will not have to worry about financing gains or bonus taxes. In the a classic IRA, money in the newest account is recognized as taxable earnings merely just after it is withdrawn, if you are Roth IRA opportunities are not taxable whatsoever most of the time.

Forget the build is also determine which kind of fund is the better for the portfolio. Mutual money can be found thanks to a brokerage or right from the brand new issuer. On the internet agents could possibly get allow you to invest in an amazing array away from ETFs, like the pursuing the. Volatility is limited that have an ETF while the the holdings are diversified. Industry ETFs are used to switch in-and-out away from circles during the monetary time periods.

It fund consists of tradeable financial assets, for example brings, bonds, currencies, futures agreements and you may/otherwise products, or certain mixture of such investment. An enthusiastic ETF, otherwise change-traded finance, is a type of money finance you to holds a diversified portfolio away from property, including stocks, products, bonds, otherwise spiders, and investments to the stock exchanges such individual holds. ETFs (Exchange-Traded Finance) combine popular features of both stocks and you may mutual fund. As opposed to common financing, ETFs trading to your transfers including brings, providing real-date cost and you can intraday trade.